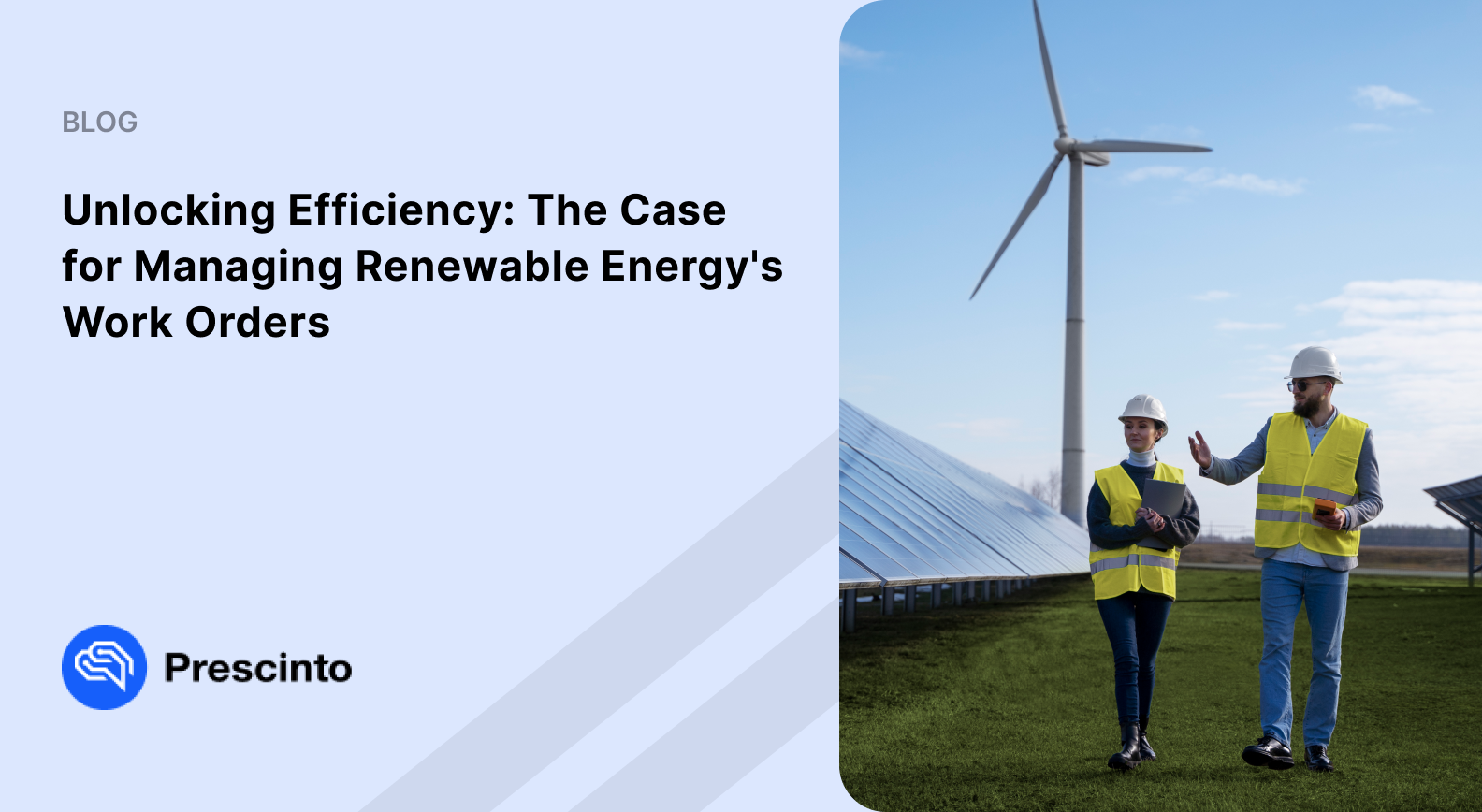

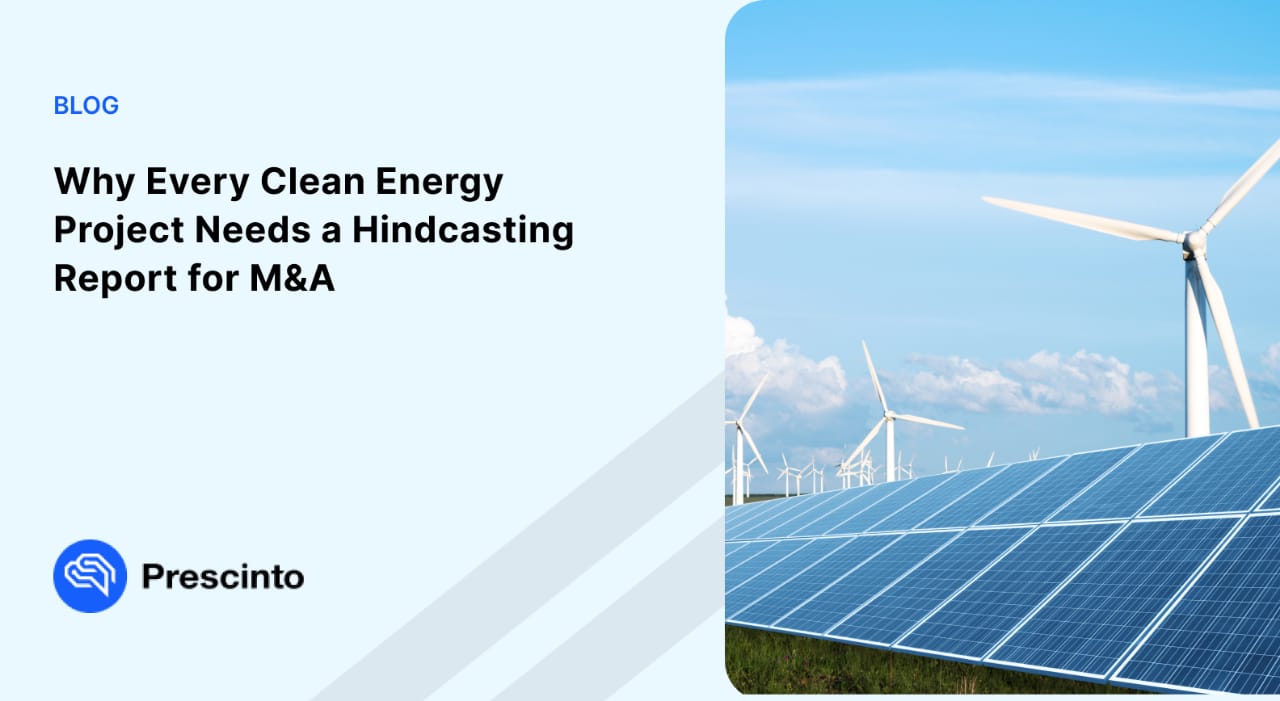

Why Clean Energy Projects Need Hindcasting Reports for M&A

- March 20, 2024

- Prescinto

Let’s take a look at the bigger picture– the future of clean energy. By the time 2050 rolls around, the visionary Biden initiatives are set to supercharge the US clean energy landscape. According to insights from the Energy Information Administration’s Advanced Energy Outlook 2023, the United States is slated to witness a remarkable 235% expansion in wind energy capacity and an impressive 1,019% increase in solar energy capacity. And that’s not all – battery storage is set to soar in tandem! Considering the growth projections, it goes without saying that precision and foresight are important in the renewable energy industry. Thus, hindcasting reports for clean energy plants play a pivotal role for the success of the projects.

Hindcasting reports provide with a unique window into the past, offering invaluable insights into the historical performance of renewable energy projects. So what exactly are hindcasting reports? What is the role played by hindcasting reports in this future of renewable energy? And why should you, as a forward-thinking renewable energy project owner, consider these reports as a crucial component of your Asset Performance Management (APM) strategy? Let’s dive deeper.

Role of Hindcasting in the Future of Renewable Energy Projects

Hindcasting is the compass guiding your renewable energy portfolio into a future of boundless possibilities. With hindcasting, you are not just predicting the future; you are shaping it. It ensuring that every megawatt generated is a step toward a more sustainable, energy-rich world.

Let’s simplify it.

What Are Hindcasting Reports?

Hindcasting reports are detailed technical reports that use historical data to assess plant health and performance. These reports are like a time machine for your renewable energy systems. They offer a deep dive into the past, providing a comprehensive analysis of how your plants have performed under various historical conditions.

Role of Hindcasting Reports in Renewable Energy Asset Valuation

Hindcasting reports can have a significant impact on the valuation of a clean energy asset by providing valuable insights into its historical performance. For asset owners, hindcasting reports can help attract investors by demonstrating the asset’s potential and minimizing perceived risks. Meanwhile, for investors, hindcasting reports provide critical information for assessing risks, determining the asset’s value, and making informed investment decisions.

Hindcasting reports are thus essential for both parties to evaluate the renewable energy asset’s past performance and make informed decisions regarding investments.

- Risk Assessment: Hindcasting reports can help identify potential risks and performance issues that may affect the asset’s value. By understanding the asset’s historical performance, investors can better assess the risks associated with the investment.

- Performance Benchmarking: Hindcasting analytics sets a benchmark for evaluating a renewable energy asset’s performance against industry standards and best practices. This information can help investors determine if the asset is operating efficiently and effectively.

- Operational Efficiency: Hindcasting reports can highlight areas where the clean energy asset’s performance can be improved. This leads to increased operational efficiency and potentially higher returns on investment.

- Asset Valuation: With the valuable data provided in hindcasting reports, the market value of renewable energy assets can be determined. This information is essential for investors, buyers, and lenders when negotiating deals.

- Decision-Making: By providing a comprehensive view of the asset’s performance, hindcasting reports enable investors to make decisions that align with their financial goals and risk tolerance. Hindcasting reports help investors make decisions about the asset, such as whether to acquire, sell, or invest in it.

What to Expect from Hindcasting Reports?

With vast geographic variations, diverse technologies, and intricate data systems, maximizing asset performance can be daunting. That’s where Prescinto steps in, offering Hindcasting Analytics. It provides critical insights and empowers asset owners and managers to make data-driven decisions for optimal performance.

Mastering Data Governance for Informed Decisions

Data surely is a gold mine, but its quality is critical. Poor data can lead to costly missteps. Prescinto’s experience and advanced data acquisition capabilities transform data from diverse sources into a unified destination. Users can harness this centralized data to build insightful dashboards and leverage the data governance tool to uncover data issues impacting their projects. With this knowledge from hindcasting reports, you can monitor and analyze your clean energy assets effectively, ensuring that every decision is informed and precise.

Your plant’s 2023 data is your APM playbook for 2024 and beyond!

Maximizing Asset Performance with Smart Recommendations

Prescinto’s hindcasting reports offer a detailed analysis of your historical data, providing insights into your clean energy plant’s past performance and trends. Utilizing your historical data, hindcasting analytics identify patterns and root causes of underperformance. The recommendation engine employs intelligent algorithms to pinpoint the root cause of silent loss trends, offering actionable recommendations to reduce production losses. It provides detailed performance and comparison insights for major components of solar and wind energy plants. This includes the yaw and pitch systems, gearboxes, generators, and rotors. This level of analysis enables plant operators to identify specific areas for improvement and optimize the performance of those critical components.

The potential impact of these insights on solar and wind energy plants is profound. By identifying and addressing root causes of underperformance, plant owners can optimize their operations, leading to increased efficiency. This detailed performance analytics for major components allow for targeted maintenance and optimization efforts, further improving overall plant performance. Implementing these recommendations can result in higher energy output, lower maintenance costs, and improved ROI for solar and wind energy plant owners.

A 3 GW Wind Turbine OEM Reduced Turbine Underperformance by 3.1% with Prescinto – Know How

Plugging Revenue Leakage with Advanced Performance and Loss Analysis

Through Prescinto’s hindcasting analysis, solar plant owners, operators, and O&M service providers can track and curb losses across 14 loss buckets. From shadow loss and snow loss to inverter efficiency loss and downtime loss, a detailed loss analysis of solar assets can give insights into the root-cause of plant underperformance and the consequential revenue leakage.

Rear-view analytics from hindcasting reports enables wind farm owners, operators, and O&M service providers to get turbine-to-turbine insights. These insights are based on historical performance gap analysis, AI-powered loss bucketing, and component-level analysis of deviations in the yaw and pitch systems. It allows for a detailed view into the performance issues and loss distribution faced by wind farms.

Tackling String Underperformance

The underperformance of DC strings can significantly affect the overall efficiency of a solar power plant. So, identifying the source of underperformance, whether it’s shading, soiling, module mismatch, or faulty wiring, is crucial. Prescinto’s String Analytics simplifies this process, enabling asset managers to quickly identify faulty or underperforming strings and diagnose issues. So they can take necessary corrective actions at the click of a button.

Ensuring Maximum Returns with Hindcasting Analytics

Renewable energy asset managers should prioritize hindcasting analytics for their renewable power plants to gain a better understanding of assets’ technical health. Prescinto’s Hindcasting Analytics identifies potential issues for prompt correction, thus averting major problems. It also pinpoints areas for operational improvement, optimizing energy output. Crucially, the third-party validation enhances investor confidence in your asset performance, minimizing perceived risks and facilitating funding for future projects.

Getting a hindcasting analytics report from Prescinto for your solar and wind energy plants is simple and effortless. Your Detailed Hindcasting Analytics from Prescinto is Just 3 Steps Away!

With just six months of historical data, four hours of your time, and a four-week timeline, you can gain deep insights into your plants’ performance. Prescinto’s user-friendly process involves providing them with your historical data and letting their experts handle the rest. In four weeks, you’ll receive a comprehensive report highlighting key insights and actionable recommendations to optimize operations and maximize efficiency of your plant. This hassle-free approach ensures quick and effortless harnessing of power through hindcasting analytics.

Prescinto’s detailed technical study supports higher asset valuations during mergers and acquisitions (M&A) or sell-off plans. It also aids in negotiating favorable terms for power purchase agreements and contracts. Thus, hindcasting analytics emerges as an essential tool. It provides actionable insights to ensure operational excellence, attract investment, and navigate the complexities of the renewable energy landscape.

- Topics: Clean Energy, Hindcasting

About Author